Ethereum was not built for the trading floor. Ethereum’s original constraint was philosophical, not financial. It prioritized credible neutrality: anyone can deploy, anyone can transact, and no participant gets structural advantages baked into the protocol.

This choice shaped everything downstream. Block times are probabilistic. Transaction ordering is adversarial. Finality arrives late, often abstracted behind rollups and relayers. For most applications, this is fine—sometimes even elegant.

For high-frequency trading, it is intolerable.

HFT systems assume three properties that Ethereum cannot guarantee at L1: predictable latency, deterministic ordering, and execution symmetry. Without them, strategies degrade into gas auctions and MEV games rather than price discovery. Ethereum doesn’t fail here accidentally; it fails by design.

Why HFTs Obsess Over Microstructure

Every trading venue—NYSE, CME, Nasdaq—eventually converges on the same truth: performance is microstructural before it is strategic.

HFTs don’t just care about speed. They care about variance. A consistent 5 ms is preferable to a jittery 1–20 ms. Determinism enables modeling; jitter destroys it.

Traditional exchanges enforce this with centralized clocks, sequencers, and co-location rules. DeFi, by contrast, externalized ordering to miners and validators, then acted surprised when trading became adversarial.

From a trader’s perspective, Ethereum is less an exchange than a hostile network environment. Alpha exists, but it leaks into infrastructure rents rather than strategy.

Fogo Chain’s Provocation: Treat the L1 Like an Exchange

Fogo Chain begins from a different premise: if most economic activity is trading, then the base layer should behave like market infrastructure.

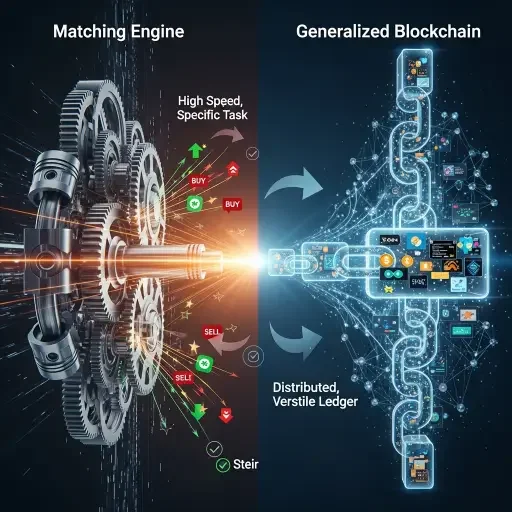

That design choice cascades. Execution is tightly ordered. Latency targets are explicit. Validator behavior is constrained to reduce variance rather than maximize optionality. In spirit, Fogo looks less like Ethereum and more like a matching engine wrapped in a blockchain envelope.

This is not neutrality maximalism. It is specialization.

Critically, Fogo does not attempt to eliminate MEV by moralizing it away. It attempts to bound it—turning extraction into something closer to exchange fees than dark-forest warfare. For traders, this is legible. Legibility is liquidity’s quiet prerequisite.

The Hidden Trade-Off: Who the L1 Is For

Ethereum’s power lies in its agnosticism. NFTs, stablecoins, DAOs, prediction markets—all coexist because the base layer refuses to care what is happening, only that it can happen.

Fogo’s risk is the mirror image. By caring deeply about one workload—trading—it implicitly deprioritizes others. General-purpose composability becomes harder when the system is tuned for low-latency determinism rather than expressive chaos.

But markets already accept this trade-off. We do not ask the NYSE to run social media applications. We ask it to clear trades reliably.

The question is not whether Fogo replaces Ethereum. It won’t. The question is whether blockchains are mature enough to specialize without apologizing.

What This Signals About the Next L1 Cycle

The first generation of L1s competed on ideology. The second competed on throughput. The next may compete on microstructure.

As crypto capital professionalizes, infrastructure will be judged less by slogans and more by execution guarantees. If Fogo succeeds, it will not be because it is more decentralized, but because it is more predictable.

That is an uncomfortable truth for a space raised on permissionlessness—but a familiar one for anyone who has ever stood on a trading floor, physical or digital.

Ethereum is a world computer that tolerates trading; Fogo is a trading machine that tolerates everything else. Next step: examine whether MEV-bounding architectures can scale without reintroducing trusted intermediaries under new names.

Tags

Related Articles

Sources

Public protocol documentation, market microstructure research, and comparative L1 design analysis