Veradermics’s Nasdaq debut is more than a new line on a ticker; it is a calibration event. For years, hair-regrowth therapies lived in venture antechambers—small-cap startups, dermatology clinics, and celebrity-fueled narratives. The IPO moves that narrative into a public market that prices not just hope, but a combination of clinical durability, reimbursement reality, and scalable unit economics. Investors must now translate before-and-after photos into discounted cash flows.

The market for hair loss treatments is large and oddly bifurcated: millions of potential patients globally, but extremely narrow commercial pathways for novel biologics. Veradermics argues it has navigated both paths—clinical data showing follicular improvement and a go-to-market built on integrated clinics and partnership channels. That position attracts capital because it shortens the runway from Phase 2 proof to revenue—if clinical durability holds.

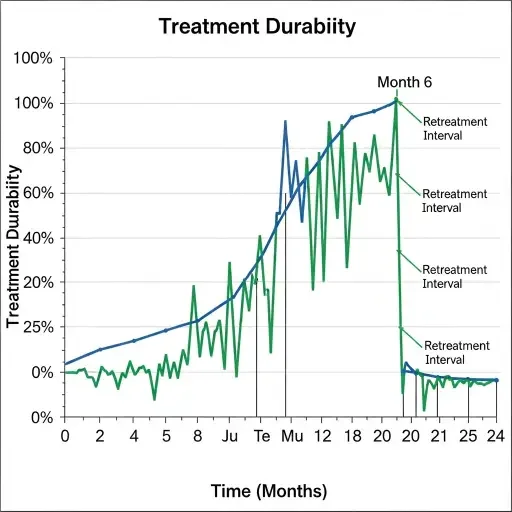

Two forces will govern whether Veradermics becomes a durable public company: clinical durability and payment. Durable means more than an improved hair count at six months; it means sustained effect, ideally measured at 12–24 months, with predictable retreatment intervals. Payment means either direct-to-consumer willingness-to-pay at clinic price points or coverage mechanisms that reduce patient churn. If neither clears consistently, the company risks high churn and underwhelming lifetime value per patient.

Clinical trials in dermatology often deliver intermediate endpoints—photometric hair-count increases, patient-reported satisfaction—but translating those into steady cash flows is nontrivial. Investors looking at Veradermics must parse reported effect sizes against historical placebo rates, measurement variability, and the common problem of regression to the mean in aesthetic endpoints. Early efficacy is necessary but not sufficient for durable market share.

Commercially, Veradermics faces a choice: scale clinics vertically or become a biologics supplier to dermatologists and medspas. Vertical clinics give control—standardized experience, data capture, and higher per-patient margins—but require capital-intensive expansion and invite local competition. Supplying clinicians allows faster geographic reach but cedes customer relationship and price setting. The IPO pitch makes clear the company prefers a hybrid: flagship clinics that validate protocols and a distributed supply model that leverages third-party operators.

That hybrid strategy addresses two investor anxieties at once. First, it creates visible revenue lines—clinic bookings and product sales—that help bridge the binary risk of late-stage trials. Second, it builds a data moat: longitudinal treatment outcomes tied to real-world usage patterns. But the moat is narrow. Platform defensibility in aesthetic medicine rarely yields the kind of network effects familiar to software platforms; instead, defensibility here is procedural standardization, clinical training, and perhaps a branded consumable that locks clinics into repeat purchases.

The capital question is pragmatic: how much cash will Veradermics need to hit break-even in adjusted EBITDA terms, and how tolerant will public investors be of extended loss-making growth? The IPO proceeds buy time, but market patience is finite. Analysts valuing aesthetics plays will use scenarios that hinge on patient acquisition cost (CAC), lifetime value (LTV), and retreatment cadence. A single unfavorable signal—higher-than-expected CAC, slower payer adoption, or a competitor showing comparable efficacy at a lower price—can compress multiples quickly.

Investors should also account for regulatory and legal tail risk. Dermatology biologics occupy a regulatory gray area when applied to largely cosmetic indications. Regulators in different jurisdictions may demand varied evidence standards; insurers may refuse to reimburse unless a condition is reclassified or compelling cost-effectiveness data emerges. Litigation risk—a small but real possibility in aesthetics where subjective outcomes and dissatisfied customers mingle—adds another asymmetric downside.

Still, there is a compelling upside story. Hair loss affects quality of life at scale, and incumbents—minoxidil, finasteride, hair transplants—leave many patients seeking better outcomes. A clinically superior, repeatable biologic with predictable retreatment economics could command premium pricing and capture a meaningful share of an addressable market measured in billions. For investors, the question is one of probabilities: what is the likelihood Veradermics converts clinical promise into durable economics before capital markets grow impatient?

A useful heuristic: value the company as a set of options rather than a single deterministic projection. One scenario assumes high clinical durability, successful hybrid commercial rollout, and modest payer acceptance—this yields a growth multiple akin to niche specialty therapeutics. A second, more conservative scenario assumes shorter durability and heavy reliance on out-of-pocket spending; that path implies lower multiples and greater sensitivity to CAC. The IPO price embeds investor beliefs about which scenario the market favors.

Consolidation dynamics matter too. If a few players demonstrate robust outcomes, acquirers—larger dermatology-focused companies or strategic pharmaceutical firms—may pay premiums to secure distribution and manufacturing scale. Conversely, if outcomes fragment and clinics pursue competing protocols, the market will fragment into local winners and losers, compressing valuations.

Veradermics’s IPO is a test of whether capital markets will underwrite a dermatology-focused biologics playbook that favors aesthetic outcomes over life-saving indications. The listing forces a reckoning: investors must price clinical evidence, clinic economics, and regulatory contours into one public valuation. For founders and managers, the imperative is clear—deliver objective durability, tighten unit economics, and show repeatable demand. Without those, the IPO will read as a diagnostic: the market told you which parts of the story were valuable and which were not.

In the end, the stock market does what private investors could not: it makes beliefs tradable and consequences immediate. For a sector built on hope and visible transformations, that immediacy will accelerate selection—sorting the durable science from the short-lived sizzle. Veradermics has bought a spotlight; now it must justify the luminance with data, dollars, and provenance.

Tags

Related Articles

Sources

Company IPO filings, investor presentations, analyst commentary, market sizing studies, dermatology clinic benchmarks.